Social and Economic Impact of the Fund

Women and children (usually girls) carry the burden of gathering the wood and collecting water which often involves arduous and time-consuming journeys daily. The impacts on quality of life and livelihoods are detrimental and plays a major role in preventing an exit from poverty for rural households. This is particularly true in the case of school absenteeism for children, especially girls, due to gathering wood duties and sickness, which further increases the gender gap.

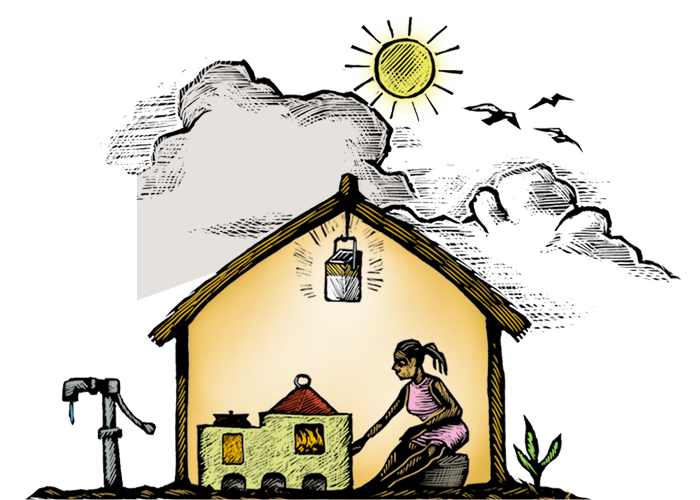

Availability of clean water to as close to the household as possible and access to improved cookstoves could save women and girls an enormous amount of time that they can use to advance their lives and to enjoy their childhood respectively.

Click here to learn more about Social-Impact-Investing